Taxes you would support raising

I have said that for big spending issues, such as infrastructure, I think a national sales tax makes sense. Everyone contributes (national sales tax) to what everyone benefits from (national infrastructure).

I also think that investment capital gains and dividends should be taxed as ordinary income. I used to believe that showing this income preferred treatment made sense, but I no longer feel that way. Maybe for older retired people, where some might be receiving income outside tax protected accounts, leaving it at a lower rate may be good.

Removing the income cap for social security and medicaid. I haven't looked in a while, I thought it was only up to maybe $100-and-some thousand that got taxed and anything beyond it was not. Think that needs atleast raised and perhaps removed.

I am hesitant to raise corporate taxes. I've heard comparisons to some of our earlier decades when corporate taxes were higher, like the 1960s and the 1980s - however the global competitive landscape is so much different now our policy makers need to be very careful and consider the total overhead that US companies must deal with compared to their global counterparts, or else, as an unintended consequence we will benefit global corporations at the expense of our domestic ones. There are other things I would like to see on the coorporate side like executive pay limits and profit sharing for employees, but I don't know how government can control those things exactly.

Cannabis. Legalize it here and in Mexico - create an export for the latter and spread tax revenues on deserving projects in the U.S. Everybody wins.

agree with pretty much everything already posted. It burns me up that people who make their fortune investing (or get paid with stocks rather than salary) pay a lower tax rate than those of us who are salaried, thanks to the capital gains tax rate. There is also something called the carried interest deduction that I don't understand but again the results are that people making a ton of money pay less taxes.

corporate tax rates are fine where they are. The problem are the loopholes (ie moving profits off - shore) that allow corporations to get away scot - free.

I'm in favor of the top tier tax rate going back to 39%. This kicks in at income over 629K for married, mid 500's for single, and is where it was before the recent tax law.

The biggest one is capital gains being taxed at the same rate as all other income.

They also need to limit loss carry forward to something like 3-5 years. It is ridiculous that billionaires and huge corporations can continue to pay no taxes because of a bone head investment they made 35 years ago. I mean, pull up your bootstraps, suck it up, and pay your taxes like the rest of us.

Education reform for K-12. Higher pay for teachers to attract better talent. Revise curriculums to eliminate standardized testing, less advanced math and science, and more social curriculums about how to navigate our world in a sensible way with daily classes on mindfulness, regular access to mental health for all students. Expand on more paths to choose from, rather than class, or tech school. And last but not least, unfortunately, increased security to protect students from terror. I'd empty my pockets for someone to do this.

Re- the income cap in SS taxes. The benefit is also capped. Removing the cap on tax is fair game, but I would think you would then remove the benefit cap too.

I would eliminate as many corporate loopholes as possible and at the same time implement a minimum rate similar to the AMT rate that applied to individuals up until recently. I would also raise the nominal corporate rate to 25%.

Secondly, I would return individual tax rates to something along the lines of 20 25, 30% based upon household income....

Thirdly, I would raise the capital gains tax to 20%

Fourth, I would raise the federal gas tax by 10 to 15 cents per gallon.

Fifth, I would eliminate the cap on income for social security withholding...Keep the cap as is for allowable annual benefit.

Finally, and this isn’t a tax per say, but a new benefit for those who wish to utilize it: I would expand the pool of working individuals who can join the Federal Thrift retirement system.

To do so we would need to be creative in the rules for eligibility and how it’s paid for. For instance, any working individual can join by agreeing to pay into the system a small percentage of their income and possibly require the employer to match that contribution up to a percentage....

How about a national lottery to lower the national debt. Set it up so that there is a winner in each state each week. With the greater chance of winning, more people would probably play, even though the payout would be lower.

Raise gas taxes? Not by 10-20 cents, unless you really want to pay more for groceries and anything else that needs to be shipped. Get rid of that .9 cent and round it up to the next penny. You would pay an extra penny every 100 gallons, but look at how many gallons are sold every day.

142.71 billion gallons of gasoline consumed in the US 2019. 47.2 billion gallons of diesel transportation fuel consumed same year. How many pennies is that?

Personally I have no issue paying higher federal gas taxes if the increased revenue is used exclusively for building and rebuilding the nations crumbling infrastructure. I always get a kick out of the individuals who drive $50-$80k vehicles they don't need whine about the price of gasoline rising even a few cents per gallon.

Gasoline has been so artificially cheap in this country for so long that even a relatively small increase makes people go crazy. The fossil fuel industry and their henchman and henchwoman in Congress hide the true cost of this fossil fuel and if we didn't people really would change their driving and purchasing habits.

Now, how we define what is infrastructure would have to be agreed upon, but as it stands the federal gas tax revenue is earmarked for specific projects and also hasn't been raised since the early part of this century and is a tax that is shared by arguable far more Americans that many others.

In other words, in terms of taxes, it's fairly well managed, affordable, and actually is targeted to specific needs.

I've always thought they should bump up the federal fuel taxes like 2 cents a year. Not enough to really impact travel or commerce expense but steadily increase revenue. Feds haven't increased their share in long time but states have.

Probably more than enough to fill an Olympic sized swimming pool. That 1/10th of a cent would add $1,427,100 to the coffers each year, and that's without adding the aviation fuel tax.

Would still need to raise fuel taxes some, but not more than 5 cents.

To add some thing about what infrastructure to include, there has to be the inclusion of rural infrastructure. In south Georgia some people are still having to make pretty long detours due to bridges damaged during the Flood of 1994 which are still unsafe for large trucks and machinery to cross due to cracks, loose pilings, and some have a slight dip in the middle of the crossing.

Larger towns, like Atlanta, pretty much eat up the state tax money. It's taken since 1964 for the DOT to fix the problem area they made at the I-75/I-16 interchange here in Macon.

Posted by: @jerryTo add some thing about what infrastructure to include, there has to be the inclusion of rural infrastructure. In south Georgia some people are still having to make pretty long detours due to bridges damaged during the Flood of 1994 which are still unsafe for large trucks and machinery to cross due to cracks, loose pilings, and some have a slight dip in the middle of the crossing.

Larger towns, like Atlanta, pretty much eat up the state tax money. It's taken since 1964 for the DOT to fix the problem area they made at the I-75/I-16 interchange here in Macon.

Seems like these rural projects should absolutely be included. However, I've got to wonder why the state has let these issues go on for 27 years. Seems like residents should have pressured their local and state representatives to fix these. Does Georgia have a proposition system like California has where people could vote to have funds set aside for this purpose, or are the people in Georgia so anti-tax that a proposition like this would be doomed to fail?

How about eliminating the exemptions for the NFL and the NCAA?

Tax exemptions need to be removed for:

- Churches

- Non profits of a purily political nature

Posted by: @2112Tax exemptions need to be removed for:

- Churches

- Non profits of a purily political nature

Absolutely 2112.....And not just at the federal level. Here in the state of New York churches and non profits pay no local property or sales tax.

Even in my area of rural upstate, NY, you can't swing a cat without hitting a church of some denomination. Not one of which pays property taxes on what in many cases are massive properties that include several buildings and several acres of land.

There's no reason houses of worship should be subsidized by the rest of the citizens of the community no matter how much good they do for that community. After all the entire community benefits from a larger and more valuable tax base. So if you want to help the needy of your community, start by paying the property taxes on that multi-million dollar property.

I think the old joke is "I'm in favor of raising a tax that I don't have to pay and someone else does."

"My friends say I'm ugly I got a masculine face." Tom Waits

Posted by: @oldcootI think the old joke is "I'm in favor of raising a tax that I don't have to pay and someone else does."

That's just the thing. Nobody is honest about what they want to spend money on and how or who will pay for it. Republicans just assume it can be borrowed in order to do this. Democrats just assume some small segment of the tax base can pay in order to do that. They are both doing the same thing, making an appeal to doing something and giving something to the people all while saying those same people don't have to pay for it. It's a lie. Piss on them both.

Posted by: @2112Posted by: @jerryTo add some thing about what infrastructure to include, there has to be the inclusion of rural infrastructure. In south Georgia some people are still having to make pretty long detours due to bridges damaged during the Flood of 1994 which are still unsafe for large trucks and machinery to cross due to cracks, loose pilings, and some have a slight dip in the middle of the crossing.

Larger towns, like Atlanta, pretty much eat up the state tax money. It's taken since 1964 for the DOT to fix the problem area they made at the I-75/I-16 interchange here in Macon.

Seems like these rural projects should absolutely be included. However, I've got to wonder why the state has let these issues go on for 27 years. Seems like residents should have pressured their local and state representatives to fix these. Does Georgia have a proposition system like California has where people could vote to have funds set aside for this purpose, or are the people in Georgia so anti-tax that a proposition like this would be doomed to fail?

There are a myriad of PLOSTs (local option sales tax) programs the county can vote to implement, but when the county only has 90,000 residents, and the local mall is a gas station/flea market/grocery store, it's a little hard to raise the money. The big problem is that the bigger cities (mainly Atlanta) get the funds to build an extra lane on a feeder street, build more on and off ramps to I-75/85/20, and put up sound barriers where contractors have built new sub-divisions close to the existing busy highways.

Seems the little bridges damaged during the Flood of 94 (mostly on county roads) take a back seat to to helping get folks from one side of Atlanta, Augusta, Columbus, or Savannah to the other maybe 5 minutes quicker.

after seeing what occurred over the past 5 years, there's no conceivable tax that could fix this country. there is no hope for the future, but there is hope for each of us to find peace in this jungle individually. in other words, the U.S. is a few slices of bread short of a ham sandwich.

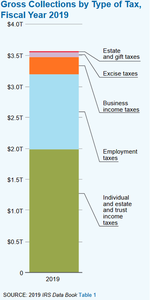

I think FY 2019 is the most current chart IRS has on their site:

https://www.irs.gov/pub/irs-pdf/p55b.pdf

As one might imagine, IRS has A LOT of tax data on their website.

Let's look at % of corporate taxes of the total collections through the years:

1959: 22.6% (individual 61%)

1969: 20.4% (individual 51.9%)

1979: 15.5% (individual 54.6%)

1989: 11.5% (individual 50.9%)

1997: 12.6% (individual 50.7%)

2009: 9.6% (individual 50.8%)

2019: 7.8% (individual 55.6%)

I'm sure that some other interesting trends could be uncovered.

https://www.irs.gov/statistics/soi-tax-stats-all-years-irs-data-books

https://www.irs.gov/statistics/soi-tax-stats-archive-1863-to-1999-annual-reports-and-irs-data-books

Then there is this

>Inside the Tax Records of the .001%</p></div></div></a><p>In 2007, Jeff Bezos, then a multibillionaire and now the world’s richest man, did not pay a penny in federal income taxes. He achieved the feat again in 2011. In 2018, Tesla founder Elon Musk, the second-richest person in the world, also paid no federal income taxes.</p><p>Michael Bloomberg managed to do the same in recent years. Billionaire investor Carl Icahn did it twice. George Soros paid no federal income tax three years in a row.</p><p>ProPublica has obtained a vast trove of Internal Revenue Service data on the tax returns of thousands of the nation’s wealthiest people, covering more than 15 years. The data provides an unprecedented look inside the financial lives of America’s titans, including Warren Buffett, Bill Gates, Rupert Murdoch and Mark Zuckerberg. It shows not just their income and taxes, but also their investments, stock trades, gambling winnings and even the results of audits.</p><p>Taken together, it demolishes the cornerstone myth of the American tax system: that everyone pays their fair share and the richest Americans pay the most. The IRS records show that the wealthiest can — perfectly legally — pay income taxes that are only a tiny fraction of the hundreds of millions, if not billions, their fortunes grow each year.</p><p>Many Americans live paycheck to paycheck, amassing little wealth and paying the federal government a percentage of their income that rises if they earn more. In recent years, the median American household earned about $70,000 annually and paid 14% in federal taxes. The highest income tax rate, 37%, kicked in this year, for couples, on earnings above $628,300.</p><p>The confidential tax records obtained by ProPublica show that the ultrarich effectively sidestep this system.</p><p>America’s billionaires avail themselves of tax-avoidance strategies beyond the reach of ordinary people. Their wealth derives from the skyrocketing value of their assets, like stock and property. Those gains are not defined by U.S. laws as taxable income unless and until the billionaires sell.</p><p>To capture the financial reality of the richest Americans, ProPublica undertook an analysis that has never been done before. We compared how much in taxes the 25 richest Americans paid each year to how much <a href= https://www.forbes.com/billionaires/>Forbes</a> estimated their wealth grew in that same time period.</p><p>We’re going to call this their true tax rate.</p><p>The results are stark. According to Forbes, those 25 people saw their worth rise a collective $401 billion from 2014 to 2018. They paid a total of $13.6 billion in federal income taxes in those five years, the IRS data shows. That’s a staggering sum, but it amounts to a true tax rate of only 3.4%.</p><p>It’s a completely different picture for middle-class Americans, for example, wage earners in their early 40s who have amassed a typical amount of wealth for people their age. From 2014 to 2018, such households saw their net worth expand by about $65,000 after taxes on average, mostly due to the rise in value of their homes. But because the vast bulk of their earnings were salaries, their tax bills were almost as much, nearly $62,000, over that five-year period.</p><p>No one among the 25 wealthiest avoided as much tax as Buffett, the grandfatherly centibillionaire. That’s perhaps surprising, given his public stance as an advocate of higher taxes for the rich. According to Forbes, his riches rose $24.3 billion between 2014 and 2018. Over those years, the data shows, Buffett reported paying $23.7 million in taxes.</p><p>That works out to a true tax rate of 0.1%, or less than 10 cents for every $100 he added to his wealth. </p><p>In the coming months, ProPublica will use the IRS data we have obtained to explore in detail how the ultrawealthy avoid taxes, exploit loopholes and escape scrutiny from federal auditors.</p><p>Experts have long understood the broad outlines of how <a href= https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3242314>little</a> the wealthy are <a href= https://www.cbpp.org/research/federal-tax/substantial-income-of-wealthy-households-escapes-annual-taxation-or-enjoys>taxed</a> in the United States, and many lay people have long suspected the same thing.</p><p>But few specifics about individuals ever emerge in public. Tax information is among the most zealously guarded secrets in the federal government. ProPublica has decided to reveal individual tax information of some of the wealthiest Americans because it is only by seeing specifics that the public can understand the realities of the country’s tax system.</p><p>Consider Bezos’ 2007, one of the years he paid zero in federal income taxes. Amazon’s stock more than doubled. Bezos’ fortune leapt $3.8 billion, according to Forbes, whose wealth estimates are widely cited. How did a person enjoying that sort of wealth explosion end up paying no income tax?</p><p>In that year, Bezos, who filed his taxes jointly with his then-wife, MacKenzie Scott, reported a paltry (for him) $46 million in income, largely from interest and dividend payments on outside investments. He was able to offset every penny he earned with losses from side investments and various deductions, like interest expenses on debts and the vague catchall category of “other expenses.”</p><p>In 2011, a year in which his wealth held roughly steady at $18 billion, Bezos filed a tax return reporting he lost money — his income that year was more than offset by investment losses. What’s more, because, according to the tax law, he made so little, he even claimed and received a $4,000 tax credit for his children.</p><p>His tax avoidance is even more striking if you examine 2006 to 2018, a period for which ProPublica has complete data. Bezos’ wealth increased by $127 billion, according to Forbes, but he reported a total of $6.5 billion in income. The $1.4 billion he paid in personal federal taxes is a massive number — yet it amounts to a 1.1% true tax rate on the rise in his fortune.</p><p>The revelations provided by the IRS data come at a crucial moment. Wealth inequality has become one of the defining issues of our age. The president and Congress are considering the most ambitious tax increases in decades on those with high incomes. But the American tax conversation has been dominated by debate over incremental changes, such as whether the top tax rate should be 39.6% rather than 37%.</p><p>ProPublica’s data shows that while some wealthy Americans, such as hedge fund managers, would pay more taxes under the current Biden administration proposals, the vast majority of the top 25 would see little change.</p><p>The tax data was provided to ProPublica after we published <a href= https://www.propublica.org/series/gutting-the-irs>a series of articles scrutinizing the IRS</a>. The articles exposed how years of budget cuts have <a href= https://www.propublica.org/article/how-the-irs-was-gutted>hobbled the agency’s ability to enforce the law</a> and how the largest corporations and <a href= https://www.propublica.org/article/ultrawealthy-taxes-irs-internal-revenue-service-global-high-wealth-audits>the rich</a> have benefited from the IRS’ weakness. They also showed how people in poor regions are now <a href= https://projects.propublica.org/graphics/eitc-audit>more likely to be audited</a> than those in affluent areas.</p><p>ProPublica is not disclosing how it obtained the data, which was given to us in raw form, with no conditions or conclusions. ProPublica reporters spent months processing and analyzing the material to transform it into a usable database.</p><p>We then verified the information by comparing elements of it with dozens of already public tax details (in court documents, politicians’ financial disclosures and news stories) as well as by vetting it with individuals whose tax information is contained in the trove. Every person whose tax information is described in this story was asked to comment. Those who responded, including <a href= https://www.documentcloud.org/documents/20798866-buffett-statement-june-2-2021>Buffett</a>, <a href= https://www.documentcloud.org/documents/20798865-bloomberg-statement-june-3-2021>Bloomberg</a> and <a href= https://www.documentcloud.org/documents/20798867-icahn-statement-june-3-2021>Icahn</a>, all said they had paid the taxes they owed.</p><p>A spokesman for Soros said in a statement: “Between 2016 and 2018 George Soros lost money on his investments, therefore he did not owe federal income taxes in those years. Mr. Soros has long supported higher taxes for wealthy Americans.” Personal and corporate representatives of Bezos declined to receive detailed questions about the matter. ProPublica attempted to reach Scott through her divorce attorney, a personal representative and family members; she did not respond. Musk responded to an initial query with a lone punctuation mark: “?” After we sent detailed questions to him, he did not reply.</p><p>One of the billionaires mentioned in this article objected, arguing that publishing personal tax information is a violation of privacy. <a href= https://www.propublica.org/article/why-we-are-publishing-the-tax-secrets-of-the-001>We have concluded</a> that the public interest in knowing this information at this pivotal moment outweighs that legitimate concern.</p><p>The consequences of allowing the most prosperous to game the tax system have been profound. Federal budgets, apart from military spending, have been constrained for decades. Roads and bridges have crumbled, social services have withered and the solvency of Social Security and Medicare is perpetually in question.</p><p>There is an even more fundamental issue than which programs get funded or not: Taxes are a kind of collective sacrifice. No one loves giving their hard-earned money to the government. But the system works only as long as it’s perceived to be fair.</p><p>Our analysis of tax data for the 25 richest Americans quantifies just how unfair the system has become.</p><p>By the end of 2018, the 25 were worth $1.1 trillion.</p><p>For comparison, it would take 14.3 million ordinary American wage earners put together to equal that same amount of wealth.</p><p>The personal federal tax bill for the top 25 in 2018: $1.9 billion.</p><p>The bill for the wage earners: $143 billion.</p><p></p><p>The idea of a regular tax on income, much less on wealth, does not appear in the country’s founding documents. In fact, Article 1 of the U.S. Constitution explicitly prohibits “direct” taxes on citizens under most circumstances. This meant that for decades, the U.S. government mainly funded itself through “indirect” taxes: tariffs and levies on consumer goods like tobacco and alcohol.</p><p>With the costs of the Civil War looming, Congress imposed a national income tax in 1861. The wealthy helped force its repeal soon after the war ended. (Their pique could only have been exacerbated by the fact that the law required public disclosure. The <a href= https://www.nytimes.com/1865/07/08/archives/our-internal-revenue-the-sixth-collection-district-in-full-official.html>annual income</a> of the moguls of the day — $1.3 million for William Astor; $576,000 for Cornelius Vanderbilt — was listed in the pages of The New York Times in 1865.)</p><p>By the late 19th and early 20th century, wealth inequality was acute and the political climate was changing. The federal government began expanding, creating agencies to protect food, workers and more. It needed funding, but tariffs were pinching regular Americans more than the rich. The Supreme Court had rejected an 1894 law that would have created an income tax. So Congress moved to amend the Constitution. The 16th Amendment was ratified in 1913 and gave the government power “to lay and collect taxes on incomes, from whatever source derived.”</p><p>In the early years, the personal income tax worked as Congress intended, falling squarely on the richest. In 1918, only 15% of American families owed any tax. The top 1% paid 80% of the revenue raised, according to historian W. Elliot Brownlee.</p><p>But a question remained: What would count as income and what wouldn’t? In 1916, a woman named Myrtle Macomber received a dividend for her Standard Oil of California shares. She owed taxes, thanks to the new law. The dividend had not come in cash, however. It came in the form of an additional share for every two shares she already held. She paid the taxes and then brought a court challenge: Yes, she’d gotten a bit richer, but she hadn’t received any money. Therefore, she argued, she’d received no “income.”</p><p>Four years later, the Supreme Court agreed. In Eisner v. Macomber, the high court ruled that income derived only from proceeds. A person needed to sell an asset — stock, bond or building — and reap some money before it could be taxed.</p><p>Since then, the concept that income comes only from proceeds — when gains are “realized” — has been the bedrock of the U.S. tax system. Wages are taxed. Cash dividends are taxed. Gains from selling assets are taxed. But if a taxpayer hasn’t sold anything, there is no income and therefore no tax.</p><p>Contemporary critics of Macomber were plentiful and prescient. Cordell Hull, the congressman known as the “father” of the income tax, assailed the decision, according to scholar Marjorie Kornhauser. Hull predicted that tax avoidance would become common. The ruling opened a gaping loophole, Hull warned, allowing industrialists to build a company and borrow against the stock to pay living expenses. Anyone could “live upon the value” of their company stock “without selling it, and of course, without ever paying” tax, he <a href= https://papers.ssrn.com/sol3/papers.cfm?abstract_id=316483>said</a>.</p><p>Hull’s prediction would reach full flower only decades later, spurred by a series of epochal economic, legal and cultural changes that began to gather momentum in the 1970s. Antitrust enforcers increasingly accepted mergers and stopped trying to break up huge corporations. For their part, companies came to obsess over the value of their stock to the exclusion of nearly everything else. That helped give rise in the last 40 years to a series of corporate monoliths — beginning with Microsoft and Oracle in the 1980s and 1990s and continuing to Amazon, Google, Facebook and Apple today — that often have concentrated ownership, high profit margins and rich share prices. The winner-take-all economy has created modern fortunes that by some measures eclipse those of John D. Rockefeller, J.P. Morgan and Andrew Carnegie.</p><p></p><p>In the here and now, the ultrawealthy use an array of techniques that aren’t available to those of lesser means to get around the tax system.</p><p>Certainly, there are <a href= https://equitablegrowth.org/working-papers/tax-evasion-at-the-top-of-the-income-distribution-theory-and-evidence/>illegal tax evaders</a> among them, but it turns out billionaires don’t have to evade taxes exotically and illicitly — they can avoid them routinely and legally.</p><p>Most Americans have to work to live. When they do, they get paid — and they get taxed. The federal government considers almost every dollar workers earn to be “income,” and employers take taxes directly out of their paychecks.</p><p>The Bezoses of the world have no need to be paid a salary. Bezos’ Amazon wages have long been set at the middle-class level of around $80,000 a year.</p><p>For years, there’s been something of a competition among elite founder-CEOs to go even lower. Steve Jobs took $1 in salary when he returned to Apple in the 1990s. <a href= https://www.washingtonpost.com/news/on-leadership/wp/2014/04/03/mark-zuckerberg-joins-the-1-salary-club/>Facebook’s Zuckerberg</a>, Oracle’s Larry Ellison and Google’s Larry Page have all done the same.</p><p>Yet this is not the self-effacing gesture it appears to be: Wages are taxed at a high rate. The top 25 wealthiest Americans reported $158 million in wages in 2018, according to the IRS data. That’s a mere 1.1% of what they listed on their tax forms as their total reported income. The rest mostly came from dividends and the sale of stock, bonds or other investments, which are taxed at lower rates than wages.</p><p>As Congressman Hull envisioned long ago, the ultrawealthy typically hold fast to shares in the companies they’ve founded. Many titans of the 21st century sit on mountains of what are known as unrealized gains, the total size of which fluctuates each day as stock prices rise and fall. Of the $4.25 trillion in wealth held by U.S. billionaires, some $2.7 trillion is unrealized, <a href= https://eml.berkeley.edu/~saez/SZ21-billionaire-tax.pdf>according</a> to Emmanuel Saez and Gabriel Zucman, economists at the University of California, Berkeley.</p><p>Buffett has famously held onto his stock in the company he founded, Berkshire Hathaway, the conglomerate that owns Geico, Duracell and significant stakes in American Express and Coca-Cola. That has allowed Buffett to largely avoid transforming his wealth into income. From 2015 through 2018, he reported annual income ranging from $11.6 million to $25 million. That may seem like a lot, but Buffett ranks as roughly the world’s sixth-richest person — he’s worth $110 billion as of Forbes’ estimate in May 2021. At least 14,000 U.S. taxpayers in 2015 reported higher income than him, according to IRS data.</p><p>There’s also a second strategy Buffett relies on that minimizes income, and therefore, taxes. Berkshire does not pay a dividend, the sum (a piece of the profits, in theory) that many companies pay each quarter to those who own their stock. Buffett has always argued that it is better to use that money to find investments for Berkshire that will further boost the value of shares held by him and other investors. If Berkshire had offered anywhere close to the average dividend in recent years, Buffett would have received over $1 billion in dividend income and owed hundreds of millions in taxes each year.</p><p>Many Silicon Valley and infotech companies have emulated Buffett’s model, eschewing stock dividends, at least for a time. In the 1980s and 1990s, companies like Microsoft and Oracle offered shareholders rocketing growth and profits but did not pay dividends. Google, Facebook, Amazon and Tesla do not pay dividends.</p><p>In a <a href= https://www.documentcloud.org/documents/20798866-buffett-statement-june-2-2021>detailed written response</a>, Buffett defended his practices but did not directly address ProPublica’s true tax rate calculation. “I continue to believe that the tax code should be changed substantially,” he wrote, adding that he thought “huge dynastic wealth is not desirable for our society.”</p><p>The decision not to have Berkshire pay dividends has been supported by the vast majority of his shareholders. “I can’t think of any large public company with shareholders so united in their reinvestment beliefs,” he wrote. And he pointed out that Berkshire Hathaway pays significant corporate taxes, accounting for 1.5% of total U.S. corporate taxes in 2019 and 2020.</p><p>Buffett reiterated that he has begun giving his enormous fortune away and ultimately plans to donate 99.5% of it to charity. “I believe the money will be of more use to society if disbursed philanthropically than if it is used to slightly reduce an ever-increasing U.S. debt,” he wrote.</p><p>So how do megabillionaires pay their megabills while opting for $1 salaries and hanging onto their stock? According to public documents and experts, the answer for some is borrowing money — lots of it.</p><p>For regular people, borrowing money is often something done out of necessity, say for a car or a home. But for the ultrawealthy, it can be a way to access billions without producing income, and thus, income tax.</p><p>The tax math provides a clear incentive for this. If you own a company and take a huge salary, you’ll pay 37% in income tax on the bulk of it. Sell stock and you’ll pay 20% in capital gains tax — and lose some control over your company. But take out a loan, and these days you’ll pay a single-digit interest rate and no tax; since loans must be paid back, the IRS doesn’t consider them income. Banks typically require collateral, but the wealthy have plenty of that.</p><p>The vast majority of the ultrawealthy’s loans do not appear in the tax records obtained by ProPublica since they are generally not disclosed to the IRS. But occasionally, the loans are disclosed in securities filings. In 2014, for example, Oracle revealed that its CEO, Ellison, had a credit line secured by about $10 billion of his shares.</p><p>Last year Tesla reported that Musk had <a href= https://www.wsj.com/articles/elon-musk-can-pocket-another-32-billion-of-tesla-shares-11619826814>pledged</a> some 92 million shares, which were worth about $57.7 billion as of May 29, 2021, as collateral for personal loans.</p><p>With the exception of one year when he exercised more than a billion dollars in stock options, Musk’s tax bills in no way reflect the fortune he has at his disposal. In 2015, he paid $68,000 in federal income tax. In 2017, it was $65,000, and in 2018 he paid no federal income tax. Between 2014 and 2018, he had a true tax rate of 3.27%.</p><p>The IRS records provide glimpses of other massive loans. In both 2016 and 2017, investor Carl Icahn, who ranks as the 40th-wealthiest American on the Forbes list, paid no federal income taxes despite reporting a total of $544 million in adjusted gross income (which the IRS defines as earnings minus items like student loan interest payments or alimony). Icahn had an outstanding loan of $1.2 billion with Bank of America among other loans, according to the IRS data. It was technically a mortgage because it was secured, at least in part, by Manhattan penthouse apartments and other properties.</p><p>Borrowing offers multiple benefits to Icahn: He gets huge tranches of cash to turbocharge his investment returns. Then he gets to deduct the interest from his taxes. In an interview, Icahn explained that he reports the profits and losses of his business empire on his personal taxes.</p><p>Icahn acknowledged that he is a “big borrower. I do borrow a lot of money.” Asked if he takes out loans also to lower his tax bill, Icahn said: “No, not at all. My borrowing is to win. I enjoy the competition. I enjoy winning.”</p><p>He said adjusted gross income was a misleading figure for him. After taking hundreds of millions in deductions for the interest on his loans, he registered tax losses for both years, he said. “I didn’t make money because, unfortunately for me, my interest was higher than my whole adjusted income.”</p><p>Asked whether it was appropriate that he had paid no income tax in certain years, Icahn said he was perplexed by the question. “There’s a reason it’s called income tax,” he said. “The reason is if, if you’re a poor person, a rich person, if you are Apple — if you have no income, you don’t pay taxes.” He added: “Do you think a rich person should pay taxes no matter what? I don’t think it’s germane. How can you ask me that question?”</p><p></p><p>Skeptics might question our analysis of how little the superrich pay in taxes. For one, they might argue that owners of companies get hit by corporate taxes. They also might counter that some billionaires cannot avoid income — and therefore taxes. And after death, the common understanding goes, there’s a final no-escape clause: the estate tax, which imposes a steep tax rate on sums over $11.7 million.</p><p>ProPublica found that none of these factors alter the fundamental picture.</p><p>Take corporate taxes. When companies pay them, economists say, these costs are passed on to the companies’ owners, workers or even consumers. Models differ, but they generally assume big stockholders shoulder the lion’s share.</p><p>Corporate taxes, however, have <a href= https://www.taxpolicycenter.org/statistics/corporate-income-tax-revenue-share-gdp-1934-2019>plummeted</a> in recent decades in what has become a <a href= https://itep.org/55-profitable-corporations-zero-corporate-tax/>golden age of corporate tax avoidance</a>. By sending profits abroad, companies like <a href= https://www.bloomberg.com/news/articles/2010-10-21/google-2-4-rate-shows-how-60-billion-u-s-revenue-lost-to-tax-loopholes>Google</a>, <a href= https://www.propublica.org/article/whos-afraid-of-the-irs-not-facebook>Facebook</a>, <a href= https://www.propublica.org/article/the-irs-decided-to-get-tough-against-microsoft-microsoft-got-tougher>Microsoft</a> and <a href= https://www.nytimes.com/2017/11/06/world/apple-taxes-jersey.html>Apple</a> have often paid little or no U.S. corporate tax.</p><p>For some of the nation’s wealthiest people, particularly Bezos and Musk, adding corporate taxes to the equation would hardly change anything at all. Other companies like Berkshire Hathaway and Walmart do pay more, which means that for people like Buffett and the Waltons, corporate tax could add significantly to their burden.</p><p>It is also true that some billionaires don’t avoid taxes by avoiding incomes. In 2018, nine of the 25 wealthiest Americans reported more than $500 million in income and three more than $1 billion.</p><p>In such cases, though, the data obtained by ProPublica shows billionaires have a palette of tax-avoidance options to offset their gains using credits, deductions (which can include charitable donations) or losses to lower or even zero out their tax bills. Some own sports teams that offer such lucrative write-offs that owners often end up paying far lower tax rates than their millionaire players. Others own commercial buildings that steadily rise in value but nevertheless can be used to throw off paper losses that offset income.</p><p>Michael Bloomberg, the 13th-richest American on the Forbes list, often reports high income because the profits of the private company he controls flow mainly to him.</p><p>In 2018, he reported income of $1.9 billion. When it came to his taxes, Bloomberg managed to slash his bill by using deductions made possible by tax cuts passed during the Trump administration, charitable donations of $968.3 million and credits for having paid foreign taxes. The end result was that he paid $70.7 million in income tax on that almost $2 billion in income. That amounts to just a 3.7% conventional income tax rate. Between 2014 and 2018, Bloomberg had a true tax rate of 1.30%.</p><p>In a <a href= https://www.documentcloud.org/documents/20798865-bloomberg-statement-june-3-2021>statement</a>, a spokesman for Bloomberg noted that as a candidate, Bloomberg had advocated for a variety of tax hikes on the wealthy. “Mike Bloomberg pays the maximum tax rate on all federal, state, local and international taxable income as prescribed by law,” the spokesman wrote. And he cited Bloomberg’s philanthropic giving, offering the calculation that “taken together, what Mike gives to charity and pays in taxes amounts to approximately 75% of his annual income.”</p><p>The statement also noted: “The release of a private citizen’s tax returns should raise real privacy concerns regardless of political affiliation or views on tax policy. In the United States no private citizen should fear the illegal release of their taxes. We intend to use all legal means at our disposal to determine which individual or government entity leaked these and ensure that they are held responsible.”</p><p>Ultimately, after decades of wealth accumulation, the estate tax is supposed to serve as a backstop, allowing authorities an opportunity to finally take a piece of giant fortunes before they pass to a new generation. But in reality, preparing for death is more like the last stage of tax avoidance for the ultrawealthy.</p><p>University of Southern California tax law professor Edward McCaffery has summarized the entire arc with the catchphrase “<a href= https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3242314>buy, borrow, die</a>.”</p><p>The notion of dying as a tax benefit seems paradoxical. Normally when someone sells an asset, even a minute before they die, they owe 20% capital gains tax. But at death, that changes. Any capital gains till that moment are not taxed. This allows the ultrarich and their heirs to avoid paying billions in taxes. The “step-up in basis” is widely recognized by experts across the political spectrum as a flaw in the code.</p><p>Then comes the estate tax, which, at 40%, is among the highest in the federal code. This tax is supposed to give the government one last chance to get a piece of all those unrealized gains and other assets the wealthiest Americans accumulate over their lifetimes.</p><p>It’s clear, though, from aggregate IRS data, tax research and what little trickles into the public arena about estate planning of the wealthy that they can readily escape turning over almost half of the value of their estates. Many of the richest create foundations for philanthropic giving, which provide large charitable tax deductions during their lifetimes and bypass the estate tax when they die.</p><p>Wealth managers offer clients a range of opaque and complicated trusts that allow the wealthiest Americans to give <a href= https://www.bloomberg.com/news/articles/2013-12-17/accidental-tax-break-saves-wealthiest-americans-100-billion>large</a> sums to their <a href= https://www.bloomberg.com/news/articles/2015-11-06/a-wal-mart-heir-is-27-billion-poorer-than-everyone-calculated>heirs</a> without paying estate taxes. The IRS data obtained by ProPublica gives some insight into the ultrawealthy’s estate planning, showing hundreds of these trusts.</p><p>The result is that large fortunes can pass largely intact from one generation to the next. Of the 25 richest people in America today, about a quarter are heirs: three are Waltons, two are scions of the Mars candy fortune and one is the son of Estée Lauder.</p><p></p><p>In the past year and a half, hundreds of thousands of Americans have died from COVID-19, while millions were thrown out of work. But one of the bleakest periods in American history turned out to be one of the most lucrative for billionaires. They added <a href= https://www.forbes.com/sites/chasewithorn/2021/04/30/american-billionaires-have-gotten-12-trillion-richer-during-the-pandemic/?sh=753db40af557>$1.2 trillion</a> to their fortunes from January 2020 to the end of April of this year, according to Forbes.</p><p>That windfall is among the many factors that have led the country to an inflection point, one that traces back to a half-century of growing wealth inequality and the financial crisis of 2008, which left many with lasting economic damage. American history is rich with such turns. There have been famous acts of tax resistance, like the Boston Tea Party, countered by less well-known efforts to have the rich pay more.</p><p>One such incident, over half a century ago, appeared as if it might spark great change. President Lyndon Johnson’s outgoing treasury secretary, Joseph Barr, shocked the nation when he revealed that 155 Americans making over $200,000 (about $1.6 million today) had paid no taxes. That group, he told the Senate, included 21 millionaires.</p><p>“We face now the possibility of a taxpayer revolt if we do not soon make major reforms in our income taxes,” Barr <a href= https://timesmachine.nytimes.com/timesmachine/1969/01/18/88979811.pdf?pdf_redirect=true&ip=0>said</a>. Members of Congress received <a href= https://www.taxpolicycenter.org/briefing-book/what-amt>more furious letters</a> about the tax scofflaws that year than they did about the Vietnam War.</p><p>Congress did pass some reforms, but the long-term trend was a revolt in the opposite direction, which then accelerated with the election of Ronald Reagan in 1980. Since then, through a combination of political donations, lobbying, charitable giving and even direct bids for political office, the ultrawealthy have helped shape the debate about taxation in their favor.</p><p>One apparent exception: Buffett, who broke ranks with his billionaire cohort to call for higher taxes on the rich. In a famous <a href= https://www.nytimes.com/2011/08/15/opinion/stop-coddling-the-super-rich.html>New York Times op-ed</a> in 2011, Buffett wrote, “My friends and I have been coddled long enough by a billionaire-friendly Congress. It’s time for our government to get serious about shared sacrifice.”</p><p>Buffett did something in that article that few Americans do: He publicly revealed how much he had paid in personal federal taxes the previous year ($6.9 million). Separately, Forbes estimated his fortune had risen $3 billion that year. Using that information, an observer could have calculated his true tax rate; it was 0.2%. But then, as now, the discussion that ensued on taxes was centered on the traditional income tax rate.</p><p>In 2011, President Barack Obama proposed legislation, known as the Buffett Rule. It would have raised income tax rates on people reporting over a million dollars a year. It didn’t pass. Even if it had, however, the Buffett Rule wouldn’t have raised Buffett’s taxes significantly. If you can avoid income, you can avoid taxes.</p><p>Today, just a few years after Republicans passed a massive tax cut that disproportionately benefited the wealthy, the country may be facing another swing of the pendulum, back toward a popular demand to raise taxes on the wealthy. In the face of growing inequality and with spending ambitions that rival those of Franklin D. Roosevelt or Johnson, the Biden administration has proposed a slate of changes. These include raising the tax rates on people making over $400,000 and bumping the top income tax rate from 37% to 39.6%, with a top rate for long-term capital gains to match that. The administration also wants to up the corporate tax rate and to increase the IRS’ budget.</p><p>Some Democrats have gone further, floating ideas that challenge the tax structure as it’s existed for the last century. Oregon Sen. Ron Wyden, the chairman of the Senate Finance Committee, has proposed <a href= https://www.finance.senate.gov/imo/media/doc/Treat%20Wealth%20Like%20Wages%20RM%20Wyden.pdf>taxing unrealized capital gains</a>, a shot through the heart of Macomber. Sens. Elizabeth Warren and Bernie Sanders have proposed wealth taxes.</p><p>Aggressive new laws would likely inspire new, sophisticated avoidance techniques. A few countries, including Switzerland and Spain, have wealth taxes on a small scale. Several, most recently France, have abandoned them as unworkable. Opponents contend that they are complicated to administer, as it is hard to value assets, particularly of private companies and property.</p><p>What it would take for a fundamental overhaul of the U.S. tax system is not clear. But the IRS data obtained by ProPublica illuminates that all of these conversations have been taking place in a vacuum. Neither political leaders nor the public have ever had an accurate picture of how comprehensively the wealthiest Americans avoid paying taxes.</p><p>Buffett and his fellow billionaires have known this secret for a long time. As Buffett put it in 2011: “There’s been class warfare going on for the last 20 years, and my class has won.”</p></div><link rel="canonical" href="https://www.propublica.org/article/the-secret-irs-files-trove-of-never-before-seen-records-reveal-how-the-wealthiest-avoid-income-tax"><meta name="syndication-source" content="https://www.propublica.org/article/the-secret-irs-files-trove-of-never-before-seen-records-reveal-how-the-wealthiest-avoid-income-tax"><script type="text/javascript" src="http://pixel.propublica.org/pixel.js" async></script>

That was rather revealing! I had no idea that the wealthy utilize loans so much, when they really don't have to, they have the financial capability to fund their own spending, but that would require them to raise more income. And like the story says, avoid income = avoid income taxes.

I don't like taxing unrealized capital gains, I do think that realized capital gains should be taxed at ordinary income rates.

Obviously we don't have a wealth tax system, so all the calculations propublica offers is as a percentage of overall or growth in wealth. It certainly offers some perspective and at the same time creates some unrealistic expectation of what these people could or should be paying. We have an income tax system and within the rules of that system, people are going to avoid paying taxes to the extent possible. Even Buffet who thinks he should be paying more, he takes advantage of all the means he and his accountants had at his disposal to pay the taxes he owes.

We got what we got through years and years, decades and decades of tax code and this is what it has ultimately produced. I feel like so many other things, has the problem, here the wealth gap, or limitations in funding our federal government, has this problem grown so large that now it simply can't be fixed? Where does it all end up? Some small number of people in Congress might want to take big swings at change, just don't ever see that happening. So we are left with small changes at the margins.

Very good post though @stormyrider. I kind of hate in a way that propublica was able to get that information, but I'm glad to have read it all.

They do talk about charitable deductions a little. I would like to see a comparable type evaluation on the total dollars of charitable giving these 25 wealthiest Americans contribute. Whether they do it for tax savings or for virtue, clearly these donations have very big and meaningful impacts on the people served by the charities they donate to. I believe you can only claim up to a certain % of your AGI in charitable giving, so it isn't like somebody could give away an equal amount of their income to wipe out their tax bill, but encouraging charitable giving is a worthy deduction in the tax code even if it is used as a tool to avoid paying some income tax.

- 74 Forums

- 14.6 K Topics

- 186.8 K Posts

- 2 Online

- 24.4 K Members